Plan your retirement

Make the most of a long-term investment

Plan your pension

| Description | Value |

|---|---|

| {{row.title}} | {{row.value}} |

Course of savings

{{table.title}}

| Year | Age | Return | Salary basis | Annual savings | Cash Withdrawal | Estimated investment return Estimated investment return | Balance |

|---|---|---|---|---|---|---|---|

| {{row.year}} | {{row.age}} | {{row.return}} | {{row.salaryBasis}} | {{row.annualContribution}} | {{row.payoutWithdrawal}} | {{row.estInvReturn}} | {{row.balance}} |

| Year | {{row.year}} |

| Age | {{row.age}} |

| Return | {{row.return}} |

| Salary basis | {{row.salaryBasis}} |

| Annual savings | {{row.annualContribution}} |

| Cash Withdrawal | {{row.payoutWithdrawal}} |

| Estimated investment return Estimated investment return | {{row.estInvReturn}} |

| Balance | {{row.balance}} |

View investement allocations advice and best practices

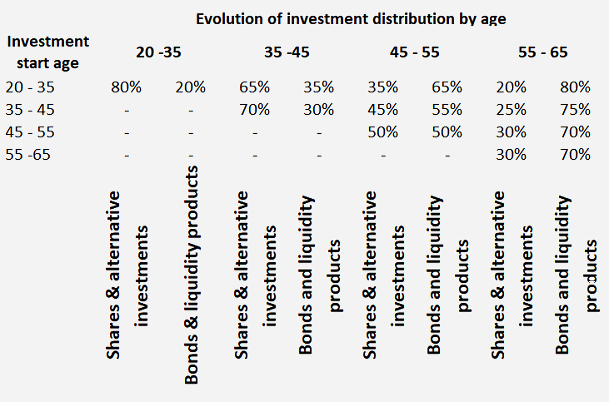

Proper allocation of your investment is the first step towards achieving your targets.Your investment allocation includes a percentage of equities or equity mutual funds and a percentage of lower investment risk products such as bonds, bond funds and Money Market products.

The basic investment approach for generating retirement capital is that the older you are, the less investment risk you may undertake. This means a greater percentage of conservative investment products as you approach retirement.

.png)

The earlier you start investing, the better. To generate long term capital gains, you should be able to assume more investment risk and therefore, you should have a long horizon in front of you. For someone beginning their investment at the age of 20, and seeking to retire at 65, it would be wise to restructure their portfolio at 35 to include a smaller percentage of equities and equity funds. In this way, one can protect their capital gains, acquiring a balanced portfolio.

However, age is not the only factor one should take into account in investment allocation process. Protecting your capital is very important for the retirement period and the more you depend on the profits generated the more conservative your portfolio should be during this period. However, depending on the added value you have generated, it may be suitable for you to invest part of your gains in a more growth-oriented portfolio. If you have the financial ability to invest in higher investment risk areas, the extra gain can offer you an additional monthly source of income during your retirement.

Disclaimer

The pension plan tool is designed for practice purposes only. In no case should it be considered part of an actual investment plan. Before making any decision, we suggest that you talk to one of our investment experts. The results produced by the tool are an approximation. They are solely based on the information you fill in and on theoretical assumptions. All the portfolios presented here are examples.

Instructions for filling in the fields in the pension calculator tool

Your age

Your age today.

Age of retirement

The age when you plan to retire.

Years of pension instalments

Number of years during which you want to receive pension.

Annual pension income

The annual income you consider adequate for covering your needs after retirement.

% of pension you must cover

The percentage of pension income you believe you must cover by saving and investing.

Current net annual income

Your net annual income. If you are married, enter the family income.

Annual income increase

The annual increase you expect in your income (average).

% of income towards savings

The percentage of your annual income that you want to save in order to create your pension capital.

Current savings

An amount you have already saved and could invest on top of the percentage of your annual income.

Annual return before retirement

The approximate annual return on your savings before you retire.

To create a satisfactory pension capital, it is essential to achieve high returns on a dynamic portfolio.

However, you should take into consideration that the expectation of high returns comes with significant investment volatility and risk of capital loss.

Annual return after retirement

After you retire, you need to secure your capitalised earnings, but also protect them against inflation.

The right strategy to follow is to maintain a conservative portfolio with an average annual return of about 1%-5%.

You should take into consideration that the expectation of high returns comes with significant investment volatility and risk of capital loss.

Inflation

Your estimate for the inflation rate.

FAQs

How can I invest in Alpha mutual funds?

Visit the Alpha Bank branch of your choice.

If you already bank with Alpha Bank:

- Find information on the mutual fund you want to invest through the Key Investor Information Document (KIID).

- Open a joint or individual trading account and choose the deposit account to be linked to it.

- Submit an application to participate in a mutual fund. Your linked bank account will be charged with the gross investment amount (invested capital + entry fees).

If you do not bank with Alpha Bank just yet, you must first open a deposit account as per the relevant bank procedure.

How can I keep track of my investment?

Daily:

- Using myAlpha Web. You only need to add your investments to your Products.

- Using the Daily price bulletin. Multiply the number of units that you own by the NAV.

Every month you receive an email detailing all your investment information. You simply need to opt for online updates when you open your trading account or request to have your settings changed later on.

Every six months you receive a statement detailing the activity in your trading account, mailed to your home address. You simply need to opt for hard-copy updates when you open your trading account.